As someone who loves to travel and shop, I have learned a few tricks along the way to make the most of my shopping experience in Europe.

One of the best ways to save money when shopping in Europe is by taking advantage of the Value Added Tax (VAT) refund program.

In this article, I will share with you my top tips on how to get the maximum VAT refund when shopping in Europe.

Understanding VAT and the Refund Process

Before we dive into the tips, let's first understand what VAT is and how the refund process works.

VAT is a consumption tax that is added to the price of goods and services in many European countries.

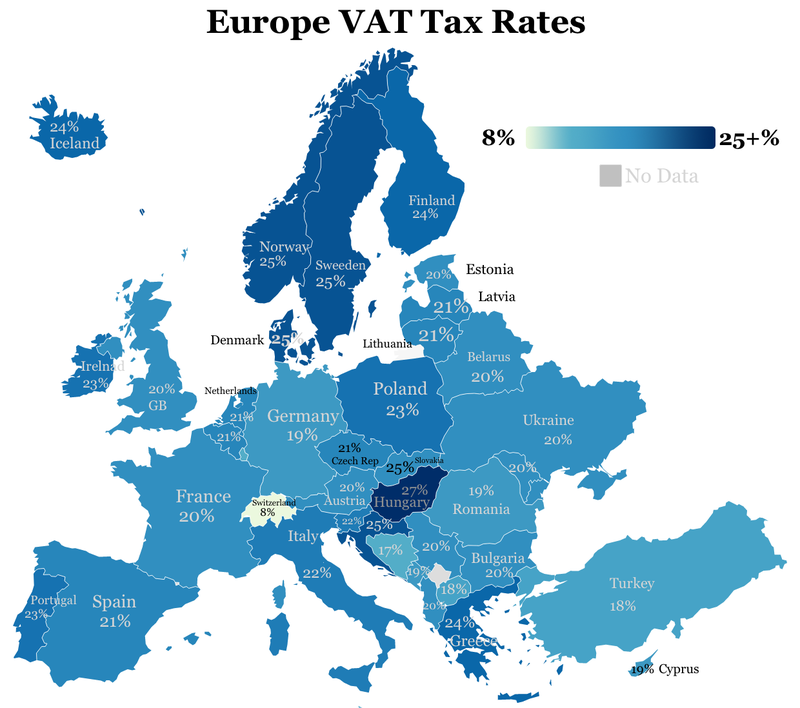

The VAT rate varies from country to country, but it is typically around 20%.

Non-EU residents are eligible for a VAT refund on goods they purchase during their visit to Europe.

What is VAT?

VAT, or Value Added Tax, is a consumption tax that is added to the price of goods and services in many European countries.

It is a percentage of the final price and is paid by the consumer at the time of purchase.

Who is Eligible for a VAT Refund?

Non-EU residents who are visiting Europe for a short period of time are eligible for a VAT refund.

To qualify, you must meet certain criteria, such as being a non-EU resident, having a valid passport, and spending a minimum amount on eligible goods.

How Does the VAT Refund Process Work?

The VAT refund process can vary slightly from country to country, but the general steps are as follows:

- Shop at stores that offer VAT refunds

- Ask for a VAT refund form at the time of purchase

- Fill out the form with your personal information

- Present the form, along with your passport and receipts, at the airport or border control when leaving the country

- Get your refund in cash or have it credited back to your credit card

Tips for Getting the Maximum VAT Refund

Now that we understand the basics of VAT and the refund process, let's dive into my top tips for getting the maximum VAT refund when shopping in Europe.

1. Shop at Stores that Offer VAT Refunds

Not all stores in Europe offer VAT refunds, so it's important to do your research before you go shopping.

Look for stores that display the "Tax-Free Shopping" or "Global Blue" logo, as these are the most common VAT refund providers.

Shopping at these stores will ensure that you are eligible for a VAT refund on your purchases.

2. Keep Your Receipts

It's crucial to keep all your receipts when shopping in Europe, as you will need them to claim your VAT refund.

Make sure to ask for a detailed receipt that clearly shows the VAT amount paid.

Without a valid receipt, you won't be able to get a refund, so be sure to keep them safe and organized.

3. Fill Out the VAT Refund Form Correctly

When you make a purchase at a store that offers VAT refunds, you will be given a VAT refund form to fill out.

It's important to fill out this form correctly and completely to avoid any issues with your refund.

Make sure to provide accurate personal information, including your name, address, and passport number.

Double-check all the information before submitting the form.

4. Claim Your Refund at the Airport or Border Control

To claim your VAT refund, you will need to present your completed VAT refund form, along with your passport and receipts, at the airport or border control when leaving the country.

It's important to allow enough time for this process, as there may be long queues and additional security checks.

Be prepared to show your purchases if requested by the customs officer.

5. Choose the Right Refund Method

When claiming your VAT refund, you will have the option to receive it in cash or have it credited back to your credit card.

Consider the pros and cons of each method before making your decision.

If you choose to receive the refund in cash, keep in mind that there may be a service fee deducted from the total amount.

On the other hand, if you opt for a credit card refund, it may take longer for the money to be credited back to your account.

Conclusion

Getting the maximum VAT refund when shopping in Europe is not difficult if you follow these tips.

Remember to shop at stores that offer VAT refunds, keep your receipts, fill out the VAT refund form correctly, claim your refund at the airport or border control, and choose the right refund method.

By doing so, you can save a significant amount of money on your European shopping spree.

Happy shopping!